How to Use Trader AI for Automated Trading & Market Predictions

Artificial intelligence has changed the way that traders trade on financial markets. Automating the execution of trades, to predicting the market’s developments, AI-powered platforms such Trader AI have transformed investment strategies. How can you make use of Trader AI to automate trading and market forecasts?

In this article we’ll explain what Trader AI works, its most important capabilities and ways to make the most of its capabilities for profitable trading.

What is Trader AI?

The Trader AI offers an innovative trading platform powered by AI that assists investors in automatizing their trading and study the market’s trends in real-time. It makes use of machines learning and big data as well as predictive analytics, to deliver reliable trading signals.

Key Features of Trader AI:

Automated execution of trades – Completes buy and sell orders with no any manual intervention.

Real-time market analysis that identifies lucrative opportunities with the help of AI algorithms.

Risk management tools – Utilizes stop-loss as well as portfolio balancing to limit the risk.

Data-driven decision-making that eliminates emotional trading and increases precision.

How to Use Trader AI for Automated Trading

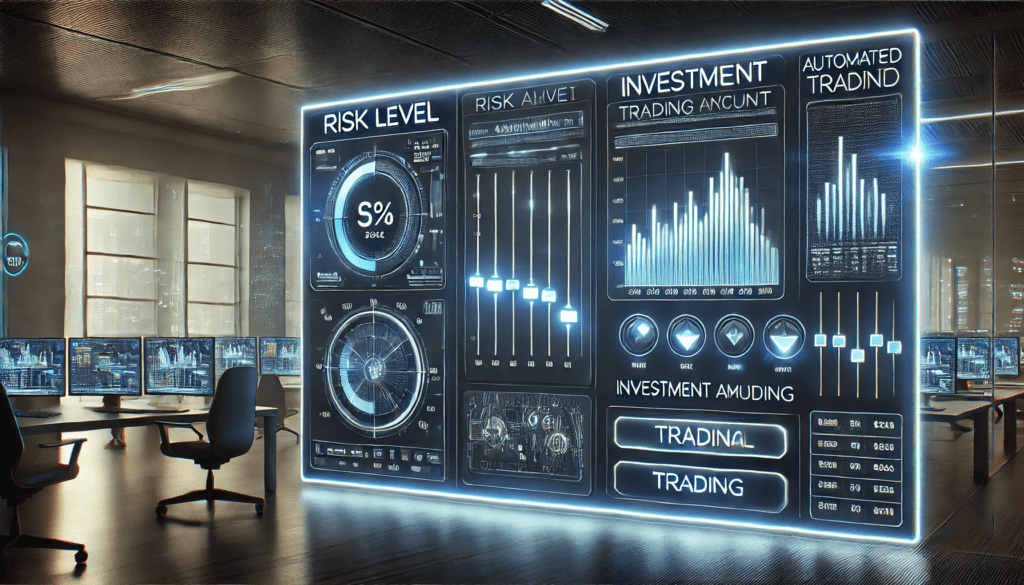

Step 1: Create an Account & Set Up Preferences

- Join the Trader AI platform.

- You can set your trading preferences (risk level and investment amount, as well as the frequency of trading).

- You can choose between manual or totally automated transactions.

Step 2: AI Market Analysis & Trade Execution

- The Trader AI examines historical and real-time data to discover trading opportunities.

- It recommends the best entry and exit points according to trends in prices.

- In the event that automated trading is turned on If Trader is enabled for automated trading, the AI makes trades instantaneously.

Step 3: Monitor & Adjust Strategies

- Check out performance reports to see the way in which it is that the AI trades.

- Set up risk settings and trade strategies to take into account the market’s developments.

- Improve your portfolio by diversifying your investments across different types of assets.

How Trader AI Predicts Market Trends

AI trading platforms depend on data analytics as well as predictive models to predict market trends. This is how the Trader AI can predict the future:

Technical Analysis – Utilizes historical prices and other indicator indicators (e.g., RSI, MACD).

Sentiment Analysis – Examines social media trends, news along with market and economic sentiment.

Machine Learning Models – Continuously improves the accuracy of its predictions by studying past market trends.

Examples: If a share or cryptocurrency has a notable positive trend, in accordance with AI indicators, the Trader AI could suggest buying as it identifies risks.

Benefits of Using Trader AI

- 24/7 Trading 24/7 Trading AI will trade if you’re sleeping.

- Speedier execution Trades are made in milliseconds, which reduces the amount of slippage.

- Reduced Human Error – Removes emotional biases in making decisions.

- Backtesting Capabilities – Allows you to test AI strategies prior to investing money in real funds.

- Yet, AI trading is not completely risk-free. Market crashes that occur suddenly, inaccurate predictions, and software malfunctions can affect the performance of your trading.

Best Practices for Maximizing Trader AI’s Potential

Begin by creating an Demo Account and test the AI’s strategies prior investing funds.

Combine AI with manual Analysis Utilize your own research and AI insights.

Set realistic expectations Set realistic expectations AI trading cannot guarantee 100 percent profit.

Always update AI settings regularly Stay on top of the market’s trends and alter the level of risk.

Conclusion

The Trader AI platform is a potent instrument for automated market forecasts and trading, however, its success is contingent on the way you utilize it. Although it provides fast execution and data-driven techniques, traders must always keep an eye on AI performance as well as manage risk and keep up-to-date with market trends.AI trading is an exciting development however, smart traders utilize it to aid their decision-making, not as replacing human judgment. If you’re looking to try AI-driven trading, begin by using a demo account, then test strategies, and then increase your investment slowly!

Read More: bizhunet